The HDFC Mudra Loan Yojana 2025 is part of the Pradhan Mantri Mudra Yojana (PMMY), a flagship initiative launched on 8 April 2015 by the Hon’ble Prime Minister of India. The scheme aims to provide collateral-free loans up to ₹10 lakh to support small industries, micro-entrepreneurs, women entrepreneurs, and small traders across the country.

HDFC Bank, being one of India’s leading private sector banks, actively provides Mudra loans under all categories—Shishu, Kishor, and Tarun—making business credit easily accessible for new and existing ventures.

Rajkot nagarik sahakari bank recruitment 2025

| Post Name : | Apprentice Peon |

| Job location : | Vakaner |

| Education Qualification : | Any Graduate |

| Last date : | 04/12/2025 |

| Apply Online | Click here |

Bilasinor Nagarpalika SWM Recruitment 2025

| Post Name | SWM (City maneger) |

| Job location | Balasinor |

| Education Qualification | B.E/B.tech |

| Interview Date | 12/12/2025 |

| Read official notification | Click here |

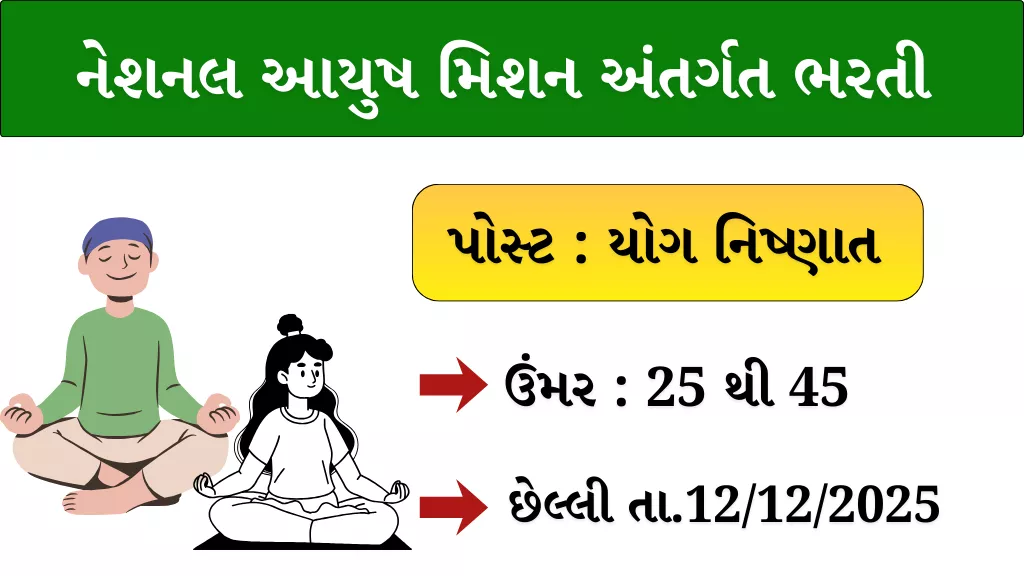

National Ayush Mission Yogexpert Recruitment 2025

| Post Name | Apprentice Peon |

| Job location | Dist. Anand |

| Education Qualification | Read notification |

| Last date | 12/12/2025 |

| Official notification | Click here |

What is HDFC Mudra Loan Yojana 2025?

Under PMMY, HDFC Bank offers loans to individuals and micro-enterprises involved in manufacturing, trading, and service sectors. The Mudra loan helps applicants start a new business or expand an existing one with low interest rates, no collateral, and quick processing.

HDFC Mudra Loan Categories (2025)

| Loan Category | Loan Amount | Purpose / Benefit |

|---|---|---|

| Shishu | Up to ₹50,000 | For new small business setups |

| Kishor | ₹50,000 to ₹5 lakh | For business expansion and medium needs |

| Tarun | ₹5 lakh to ₹10 lakh | For large-scale growth and expansion |

These categories ensure that businesses at different stages receive the right amount of financial support.

Types of Loans Under PM Mudra Yojana

- Shishu Loan – Up to ₹50,000

Ideal for first-time entrepreneurs and very small businesses. - Kishor Loan – ₹50,000 to ₹5,00,000

Suitable for businesses looking to upgrade or expand operations. - Tarun Loan – ₹5,00,000 to ₹10,00,000

Offered to enterprises requiring larger investments for growth.

Eligibility Criteria for HDFC Mudra Loan 2025

To apply for a Mudra loan through HDFC Bank, you must meet the following conditions:

- The applicant must be involved in manufacturing, trading, or service activities.

- Must be a non-agricultural micro-enterprise.

- The business’s financial requirement must be below ₹10 lakh.

- The applicant should have a clear credit history (if applicable).

- Both new and existing businesses are eligible.

Documents Required for HDFC Mudra Loan

Applicants must submit the following documents:

- Identity Proof – Aadhaar Card / PAN Card

- Address Proof – Electricity bill, Ration card, Aadhaar Card

- Income Proof – ITR of last 2 years (if available)

- Bank Statement – Last 6 months

- Loan Application Form – Duly filled

- Office Address Proof – Rent agreement/ownership papers

- Business Registration Certificate – License, GST, Shop Act (if applicable)

- Business References – Trade details or vendor references

How to Apply for HDFC Mudra Loan (Step-by-Step Guide)

Applying for a Mudra loan at HDFC Bank is quick and simple:

Step 1: Visit the nearest HDFC Bank Branch

Ask for the Mudra Loan Application Form.

Step 2: Fill out the Form

Provide correct business and personal details.

Step 3: Attach Documents

Submit identity proof, address proof, financial documents, and business details.

Step 4: Verification by Bank Officials

The bank will check eligibility and assess the business plan.

Step 5: Loan Approval & Disbursement

Once approved, the loan amount is directly credited to your bank account.

Key Benefits of HDFC Mudra Loan

- Collateral-free loan (no property required)

- Affordable interest rates

- Quick processing & minimal documentation

- Supports new business startups

- Helps expand existing enterprises

- Ideal for shopkeepers, small traders, and women entrepreneurs

- Read Along App With Google

- LIC Bima Sakhi Yojana Gujarat

- Gujarat Agriculture Universities Recruitment 2025: 227 Junior Clerk Posts – Apply Now!

- SSC GD Constable Recruitment 2025: Apply Online for 25,487 Vacancies

- Gujarat PSI Constable Recruitment 2025 – Apply Online for 13,591 Posts | Notification Out

- Sabarkantha Traffic Brigade Recruitment 2025 – Apply for 13 Posts, Check Eligibility & Application Process

Important Features of PM Mudra Yojana via HDFC Bank

- Available for small and medium enterprises.

- Loans offered in three flexible categories depending on requirements.

- Customer-friendly processing with fast approval.

- Supports thousands of small-scale entrepreneurs across India.

Important links

| Official website | Click here |

| Home page | Click here |

Conclusion

The HDFC Mudra Loan Yojana 2025 is an excellent opportunity for small business owners and aspiring entrepreneurs looking for easy financial support. With quick approvals, low interest rates, and no collateral, this scheme is one of the best funding options for micro and small businesses in India.

If you want to start or expand your business, applying for an HDFC Mudra Loan can be a smart and beneficial step.

Frequently Asked Questions (FAQ)

1. Who is eligible for a Mudra Loan?

Any non-agricultural micro-enterprise involved in manufacturing, trading, or services with financial needs under ₹10 lakh.

2. What documents are required?

Aadhaar/PAN, address proof, bank statements, ITR, business details, and application form.

3. What is the interest rate for HDFC Mudra Loans?

Interest rates vary based on applicant profile, business type, and loan amount. Rates remain affordable and competitive.

4. Is collateral required?

No, Mudra loans are collateral-free